how much taxes does illinois take out of paycheck

For the employee above with 1500 in weekly pay the calculation is 1500 x. 2674 Amount taken out of an average biweekly paycheck.

Paycheck Calculator Take Home Pay Calculator

How much taxes does Virginia take out of your paycheck.

. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. 495 percent Effective for tax years ending on or after December 31 2020 the personal exemption amount is 2325. Illinois Salary Paycheck Calculator.

How do I calculate how much tax is taken out of my paycheck. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year and the subsequent year. 0495 for tax years ending on or after.

According to the Illinois Department of Revenue all incomes are created equal. FICA taxes are commonly called the payroll tax. How much income tax do I pay in Chicago.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. FICA taxes consist of Social Security and Medicare taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Simply enter your pay frequency Federal and State W-4 elections and salary. That makes it relatively easy to predict the income tax you will have to pay. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

The calculator will do the rest. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

For the employee above with 1500 in weekly pay the calculation is 1500 x. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. The Medicare tax rate is 145.

To find out what impact a taxable tuition waiver will have on your net pay enter the waivers received year-to-date below the calculator and taxes and net pay will update accordingly. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. How much tax is deducted from my paycheck in Illinois.

Deductions may be made. Unlike Social Security all earnings are subject to Medicare taxes. It is not a substitute for the advice of an accountant or other tax professional.

Employees who file for exemption from federal income tax must still have Medicare taxes. TOP 5 Tips Illinois has a flat income tax of 495 which means everyones income in. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

What is the Illinois tax rate for 2020. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. FICA taxes consist of Social Security and Medicare taxes.

Total income taxes paid. The law allows other deductions for. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Total income taxes paid. For more information see Publication 131 Withholding Income Tax Filing and Payment Requirements. What Do Small Business.

Employers in Illinois must deduct 145 percent from each employees paycheck. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. It is not a substitute for the advice of an accountant or other tax professional.

However they dont include all taxes related to payroll. How do I calculate how much tax is taken out of my paycheck. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

If you increase your contributions your paychecks will get smaller. With the express written consent of the employee given freely at the time the deduction is made. Social Security withholding is 62 of your income while Medicare withholding is 145 of your income each pay periodIncome Tax Brackets.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

No Illinois cities charge a local income tax. These amounts are paid by both employees and employers. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the. No Illinois cities charge a local income tax on top of the state income tax though.

How Much Tax Does Illinois Take Out Of Your Paycheck. When required by law such as taxes to the benefit of the employee such as health insurance premiums union dues etc. Illinois Hourly Paycheck Calculator.

The income tax rate remains at 495 percent. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. The income tax rate in Illinois is 495 after an increase from 375 in 2017.

A valid wage assignment or wage deduction order in effect made. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Tax What It Is How To Calculate It Bench Accounting

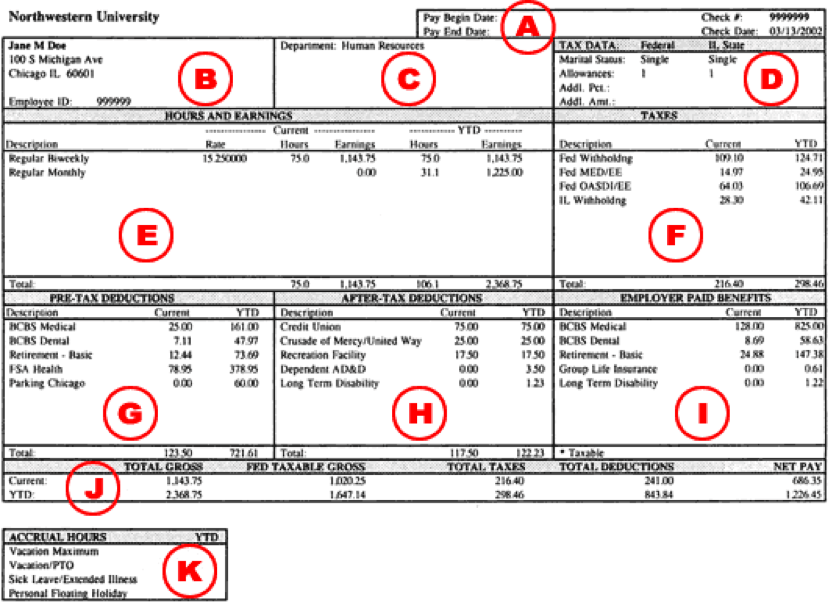

Understanding Your Paycheck Human Resources Northwestern University

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Texas Paycheck Calculator Smartasset Com Paycheck Nevada Calculator

The Anatomy Of An American Paycheck Millionaire Before 50

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Celebrating America Saves Week 7 Ways To Automate Your Savings Plan Well Retire Well How To Get Money Money Financial Financial Help

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Is Casdi Employer Guide To California State Disability Insurance Gusto

We Make A Set Of 3 Consecutive Paycheck Stubs Pay Stubs Come Complete With Earnings Taxes Deductions And Ytd Tot Paycheck Payroll Template Payroll Checks

Paycheck Calculator Take Home Pay Calculator

State By State Guide To Taxes On Retirees Retirement Income Income Tax Retirement

Here S How Much Money You Take Home From A 75 000 Salary

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Finance Investing Infographic Math Review